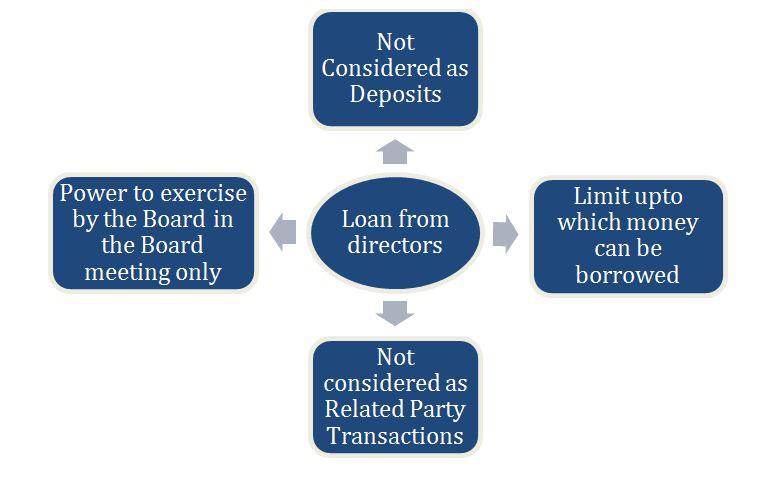

Borrowing from Directors under the Companies Act, 2013

Introduction: Under the Companies Act, 2013, there is no specific section that directly addresses loans from directors. Instead, these transactions are subject to scrutiny through the lens of restrictions imposed on borrowings by companies. This article explores key aspects related to loans from directors and the regulations surrounding them.

1. Will the loan from Directors be treated as a deposit?

Loans from Directors are not considered as deposits [Rule 2(1)(vii) of the Companies (Acceptance of Deposits) Rules, 2014]. Such loans are exempted and are not classified as "deposits" under the Act.

2. Can the Company accept a loan from a relative of a Director?

The acceptance of a loan from relatives of directors is exempted, but this exemption applies only to private companies. It is essential to ensure that the funds provided by a relative of a Director are not borrowed funds.

3. What are the reporting requirements for a loan from Directors?

As per the explanation to Rule 16 of the Companies (Acceptance of Deposits) Rules, 2014, companies must file e-form DPT-3 for transactions not considered as deposits (i.e., "Exempted Deposits"). Since loans from Directors fall under this category, they should be reported as Exempted Deposits.

4. What are the other disclosures applicable to the company accepting a loan from Directors or relatives of Directors?

Companies accepting loans from Directors or their relatives must comply with the following:

· Directors or their relatives should provide a written declaration that the funds are not borrowed.

· Details of the money accepted must be disclosed in the Board's Report.

· Financial statements should include notes regarding the money received from directors or relatives of directors.

5. Is there any limit up to which money can be borrowed from the Director?

The law does not specify a specific limit for loans from directors. However, there is an overall limit for borrowing by a company under Section 180(1)(c) of the Act. If the borrowed money, combined with existing borrowings, exceeds the aggregate of paid-up share capital, free reserves, and securities premium, a special resolution of the members is required.

6. Is the borrowing limit stated above applicable to a Private Limited Company?

Pursuant to a Ministry of Corporate Affairs notification dated June 5, 2015, Section 180 of the Companies Act, 2013, does not apply to private companies. Public limited companies are subject to additional requirements for shareholders' approval via special resolution.

7. Can the resolution to borrow funds be passed by circulation?

Borrowing power can only be exercised by the board during a duly convened board meeting. This means that resolutions approving borrowing cannot be passed through circulation.

8. What is the step-by-step procedure to accept a loan from a Director or his/her relative?

· The procedure includes:

· Holding a board meeting to pass the resolution for accepting the loan and setting the limit.

· Obtaining a signed declaration from the Director or their relative confirming the non-use of borrowed funds.

· Executing a loan agreement with all terms and conditions.

· Filing e-form DPT-3.

· Disclosing loan details in the Board's Report.

· Including disclosures of amounts received from relatives of directors in the Financial Statements.

9. Is a loan from a Director considered as a Related Party Transaction (RPT)?

Directors or Key Managerial Personnel (KMP) are considered related parties under Section 2(76) of the Act. However, only transactions specified in Section 188(1) of the Act are classified as related party transactions. Since borrowing money is not covered under Section 188, loans from directors are not considered RPTs.

Post a comment